Ignore the Noise: This Market Belongs to Real Estate Investors

- Jes Fields

- Oct 26

- 3 min read

I’ll admit it — I must limit how much time I spend reading housing-market headlines. Between the doom-and-gloom predictions and the “once-in-a-lifetime crash” warnings, it’s easy to get sucked into the noise. Still, as someone who spends a lot of time studying the market, I’ve come to one clear conclusion: right now is a good time to invest in real estate. Here’s why.

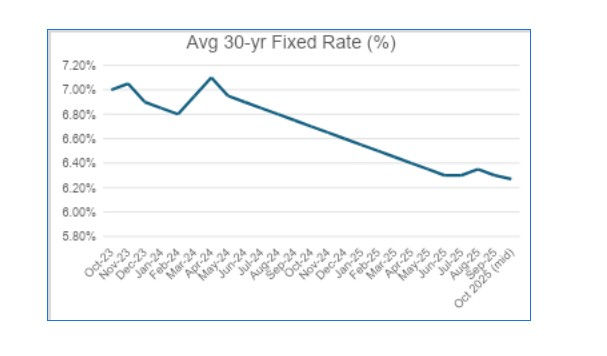

Mortgage Rates Have Declined and Stabilized

After two years of volatility, mortgage rates have finally steadied — and even declined. The average U.S. 30-year fixed mortgage rate is now in the low-6% range, about 100 basis points lower than October 2023 (source: Freddie Mac).

Lower rates are a clear win for investors. Reduced borrowing costs mean improved deal profitability, better refinance opportunities, and even the ability to pull cash out of existing properties to fund new deals. In short, investors can make stronger offers, finance more efficiently, and scale faster.

Buyers Have More Power

When markets shift, like they are now, it takes time for buyers and sellers to adjust their expectations. But as we see homes sitting on the market longer (up to 62 days last month, according to Realtor.com), buyers are gaining control of the transaction.

Depending on the market (and I highly recommend consulting an experienced real estate agent for localized advice), real estate investors can take advantage of the shifting market and look for opportunities to ask for price reductions, seller credit towards rehab, home warranty, or closing cost credits.

Competition Has Cooled

Consumer uncertainty — tied to a softening job market — has sidelined many would-be homeowners.

August 2025, there were 35% more home sellers than buyers — roughly 505,000 more listings nationwide (source: Redfin). Even more telling, 15% of home-purchase contracts were canceled in September, the highest in years.

That means less bidding-war chaos and more opportunity to buy smart. Investors can analyze deals thoroughly, negotiate from a position of strength, and pick up assets that emotional retail buyers are walking away from.

Labor is Freeing Up

Large homebuilders are pulling back on new starts, which is loosening up skilled labor availability. According to John Burns Research & Consulting, major builders are sitting on roughly 2.6 unsold homes per community, prompting them to slow construction.

This shift benefits smaller investors. With general contractors and tradespeople seeking steady work, investors who build strong relationships locally can secure faster turn times, more reliable crews, and better pricing on rehab or new-build projects.

Access to Private Capital

There is a growing surge of private capital flowing into real estate, and investors should take notice. According to Morgan Stanley’s 2025 Private Credit Outlook, private credit is projected to rise from 1.5 trillion dollars in 2024 to over 2.5 trillion by 2029. As traditional banks shy away from or tighten underwriting, private lenders are stepping in with more flexible terms and greater speed.

For active real estate investors, this means more funding options, faster approvals, and the ability to move when others can’t. If you’re still relying on personal liquidity or local banks, it’s time to explore the agility that private money lenders can offer.

More Inventory Available

Inventory is finally growing — and staying on the market longer. Rising cancellations, more than 72,000 foreclosures in Q3 2025 (source: ATTOM Data), and hesitancy from traditional buyers are all contributing to an expanding pool of available homes. For investors, this translates into more deal flow and less competition. The market is offering breathing room to analyze, negotiate, and buy selectively — a welcome change after years of tight supply and bidding wars.

Risks Still Exist

Every opportunity comes with risk. Market shifts, financing costs, contractor challenges, or poor exit planning can erode profits quickly. Success still depends on preparation, partnerships, and discipline.

Surround yourself with experienced real estate agents, reliable contractors, and trusted lenders who specialize in investment property. And never invest without a clear — and flexible — exit strategy.

The Smart Money Is Moving Now

While others are waiting for the “perfect” moment, seasoned investors know opportunity comes when the market is uncertain — not when it’s comfortable.

Real estate remains one of the most powerful tools for long-term wealth creation because it offers multiple pathways to build value: steady cash flow from rental income, appreciation over time, tax advantages through depreciation and deductions, and the ability to leverage equity into new opportunities.

If you’re ready to explore your next investment opportunity, connect with J-Rev Solutions to access efficient capital, market insight, and expert support tailored for investors and developers.

Visit www.jrevsolutions.com to learn how to move faster, smarter, and more confidently in today’s housing market — and start building lasting wealth through real estate.

Comments